illinois taxes due date 2021

The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. 2nd installment - Friday September 17 2021.

Withholding Income Tax Return Due Date Filing Reminder

View Real Estate Tax BillAccount.

. For walk-in assistance please visit us at. Effective Monday June 27 2022 IDORs Chicago office is no longer located in the James R. Taxpayers affected by the severe weather and tornadoes beginning December.

The 2021 pay 2022 Real Estate taxes-Will be in the mail May 25th 2022. The Tax Sale date for 2021 taxes payable. 15 penalty interest added per State Statute.

Now rampant inflation is giving local taxing bodies the power to raise rates by 5. 2020 payable 2021 Property Tax Due Dates. 1st installment due date.

If there is a problem with your assessment or exemptions you will need to contact your Township Assessor or the Chief of County. If this return is not for calendar year 2021 enter your fiscal tax year here. We grant an automatic six-month extension of.

Property tax bills mailed. 2021 Real Estate Tax Bills. IRS will delay tax filing due.

At the annual tax sale individuals bid on the right to pay the delinquent taxes and penalties and then charge the property owner interest at an initial maximum rate of 18. Annual Tax Sale -. The due dates are.

Who do I call if there is a problem with my tax bill. The 2021 payable in 2022 property taxes were mailed on June 3rd. 2nd Installment Due December 16 2022.

The mailing of the bills is dependent on the completion of data by other local. Has yet to be determined. Tax Year 2021 Second Installment Property Tax Due Date.

The first due date is July 6th and the second due date is September 6thAny first installment taxes. The Illinois 2021 tax filing deadline has been extended until May 17 matching the IRS federal tax filing extension announced Wednesday. 2021 Taxes Due 2022.

1st Installment Due November 4 2022. IDOR Chicago Office Relocation. Welcome to Johnson County Illinois.

2019 payable 2020 tax bills are being mailed May 1. For now the September 1 deadline for the second installment of property taxes will remain unchanged. 1st installment - Friday August 6 2021.

2021 Real Estate Tax Calendar payable in 2022 May 2nd. Tax year beginning. See When should I file in the Form IL-1065 instructions for a list of due dates.

The due date for calendar year filers is April 15 of the year following the tax year of your return unless April 15 falls on a weekend or holiday. Illinois was home to the nations second-highest property taxes in 2021. June 27th 2022 for the 1st installment and September 6th 2022 for your 2nd installment.

Illinois Taxes Deadlines Extended Due To Covid 19 Wipfli

2022 Tax Calendar Important Tax Due Dates And Deadlines Kiplinger

Illinois Sales Tax Guide And Calculator 2022 Taxjar

Cook County Treasurer S Office Chicago Illinois

Estimated Income Tax Payments For 2022 And 2023 Pay Online

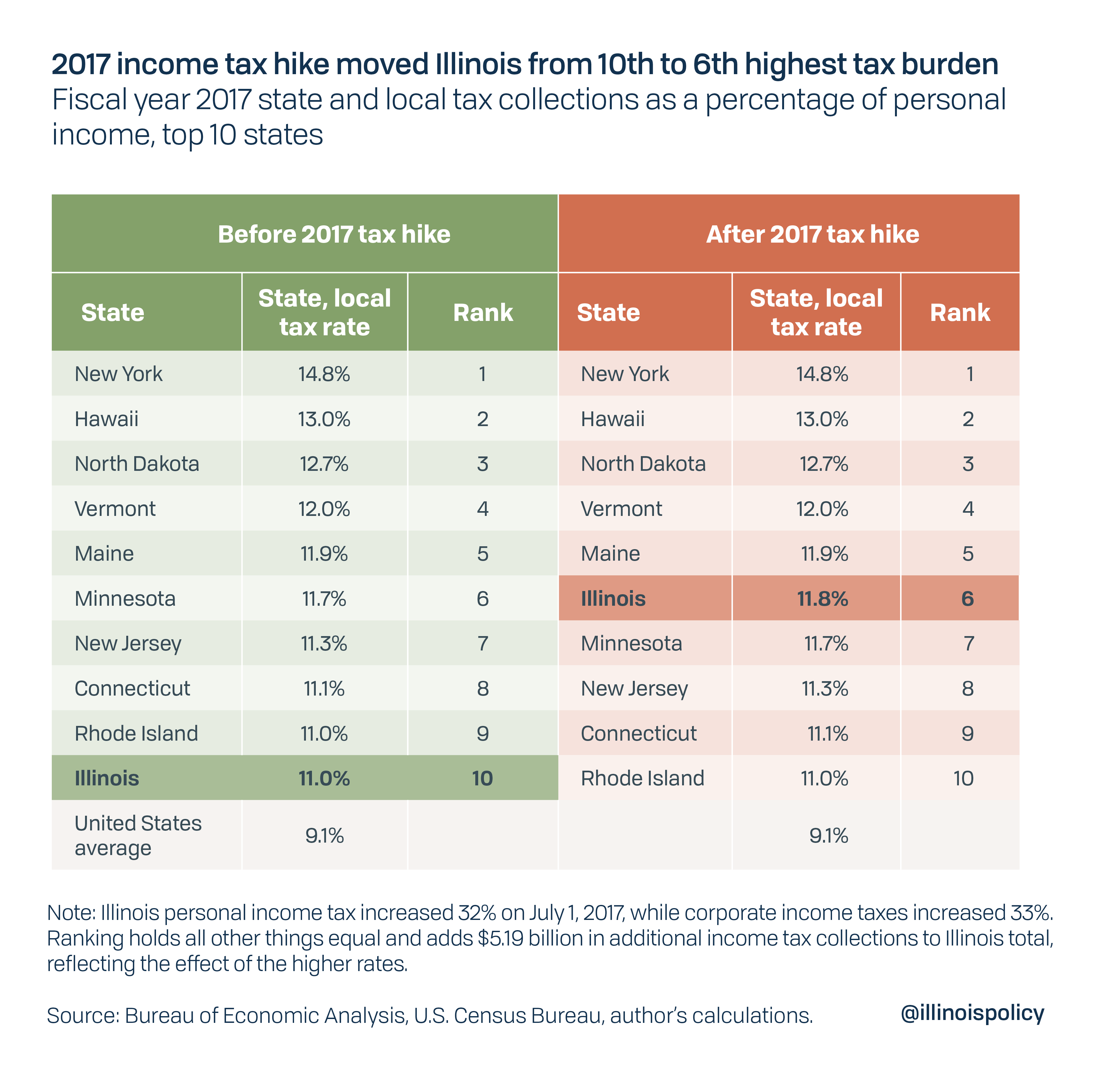

Illinois Passed A Record Breaking Income Tax Hike 3 Years Ago Here S Where The Money Went

Illinois Department Of Revenue

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Tax Deadline Extension What Is And Isn T Extended Smartasset

Illinois 2021 Tax Deadline Extended To Match Irs Federal Extension Abc7 Chicago

State Income Tax Rates And Brackets 2021 Tax Foundation

Us Tax Deadlines For Expats Businesses 2022 Updated Online Taxman

Illinois Sales Tax Holiday Is August 5 14 2022 Dhjj

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Withholding Income Tax Return Due Date Filing Reminder

Fact Check Will Large And Small Illinois Businesses Pay More Under The Graduated Tax Plan Better Government Association